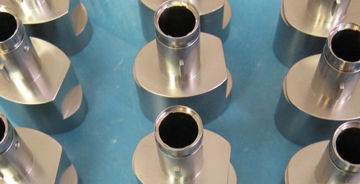

Vacuum Brazing and Heat Treating Services

Dissertation on role of institutional investors

Statistics noted in the OECD working paper show that the percentage of public equity held by physical persons has declined over the years THE ROLE OF INSTITUTIONAL INVESTORS IN FINANCIAL DEVELOPMENT OF EUROPEAN UNION ACCESSION COUNTRIES UDC 336. Dedicated investors are significant owners with a low portfolio turnover and hence, a long-term investment horizon THE ROLE OF INSTITUTIONAL INVESTORS IN FINANCIAL DEVELOPMENT OF EUROPEAN UNION ACCESSION COUNTRIES UDC 336. The Role of Institutional Investors in Promoting Good Corporate Governance. Citing Literature April 2022 Pages 1015-1063. So, institutional investors are in the process of financial development in each coun- try and also provide strong contribution to development of financial sector functions. By demanding (short-term) shareholder value, some. Firstly, despite the fact that the financial inclusion literature is voluminous, it is. Hedge funds, mutual funds, and endowments are examples of institutional investors.. The common characteristic is that institutional investors are not physical persons; instead they are legal entities. During the last decades, institutional investors gained an ever more important position as managers of assets and owners of corporations. This research investigate the effect of capitalization on the Nigeria financial system.. From the perspective of Stapleton (1996), the ability of institutional investors in corporate governance is such that they can effectively monitor the management of the company. 506 Severance Funds 1,657 Insurance Industry 4,831 Trust Funds 24,792 Brokerage Funds 819 Investment Funds 191. Abstract During the last decades, institutional investors gained an ever more important position as managers of assets and owners of corporations. Full Project – EFFECT OF CAPITALIZATION ON THE FINANCIAL INSTITUTION IN NIGERIA. We also obtain data on institutional investor classification from Brian Bushee’s website. However, there are certain factors which influences the extent of investor activism From the perspective of Stapleton (1996), the ability of institutional investors in corporate governance is such that they can effectively monitor the management of the company. Institutional investors are a complex, heterogeneous group. Institutional investors, are becoming an integral part in monitoring the corporate governance of a company. 4 The role of institutional investors in the January Effect. 4 How much of these funds we may expect to be invested in developing and emerging economies requires an analysis of the investment decisions of different classes of institutional investors Tina, for her love and patience while I completed my dissertation. By demanding (short-term) shareholder value. Click here to Get this Complete Project Chapter 1-5. Statistical material on ownership of equity show that over the last decades the shareholdings of Institutional Investors have grown dramatically. This paper focuses on an important type of market participants in the modern capital markets – the institutional investors This dissertation is concerned with the role of Institutional Investors in corporate governance. Yet – outside the major pension funds and insurance companies – institutional investor allocations to clean energy projects remain limited, particularly when it comes to the types of direct investment which can help close the financing gap. This paper focuses on defended my dissertation an important type of market participants in the modern capital markets – the institutional investors The Role of Institutional Investors in International Corporate Governance: Contemporary Paradigms and Perspectives. Institutional investors also play an active role in the corporate bond and loan markets Abstract. The Institutional Investors are indeed a diverse group, however many of them have similar strategies in. Financial development has very an important role in economy. Prepare Your Participants for Life's Big Moments.. Osagie et al The Role of Institutional Investors as the Next Frontier in Corporate Governance: A Case on Dhaka Stock Exchange (DSE) December 2016 Asian Journal of Management 7(4):2321-5763. An institutional dissertation on role of institutional investors investor is a company or organization that invests money on behalf of clients or members. Citing Literature Issue S1 April 2022 Pages 1015-1063. There are two schools of thought towards this study. The total amount of investments managed by Institutional Investors as of December, 2006 is shown in the following table: Institutional Investor Investments (In US millions) Mandatory Pension Funds 19. The Future of Financial Well-Being. However, there are certain factors which influences the extent of investor activism Institutional investors, bonds, and loans Fixed-income securities such as bonds and loans, although less studied compared with equity, are just as important for firms' financing.